CA FTB 4107 2022-2026 free printable template

Show details

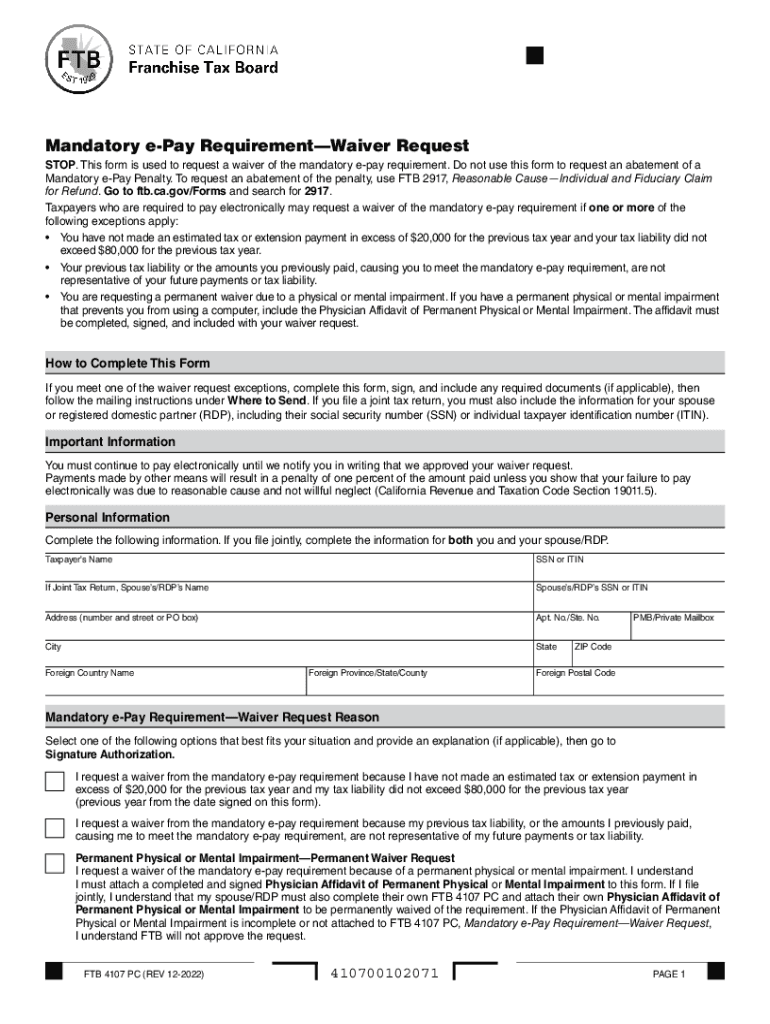

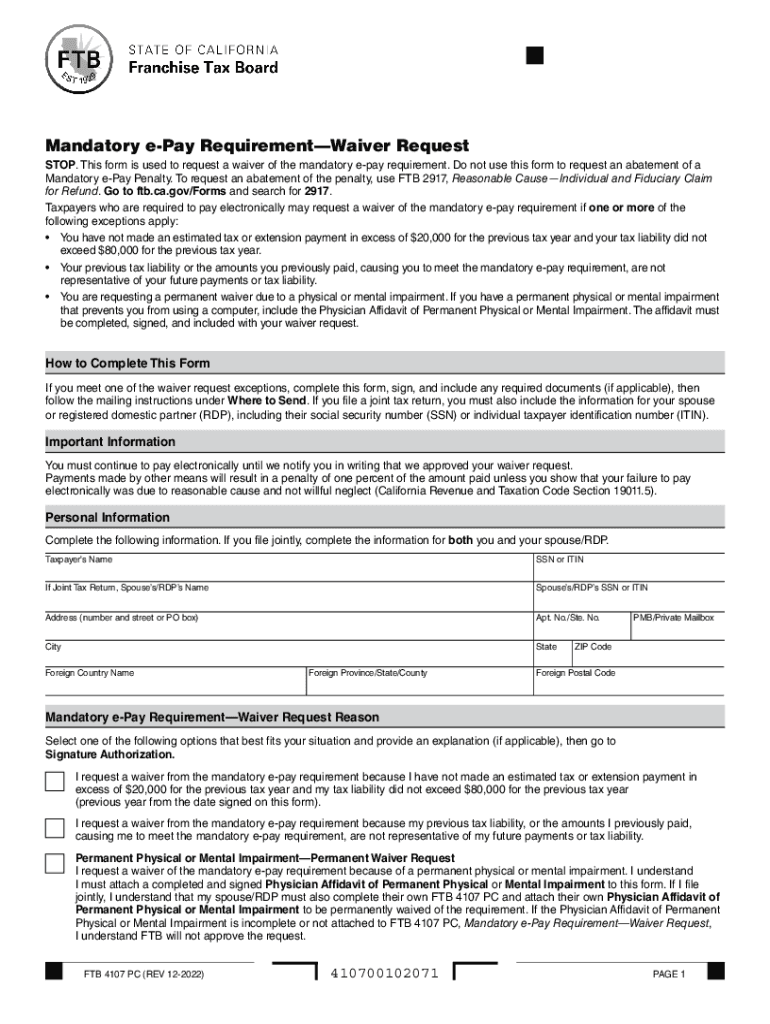

Permanent Physical or Mental Impairment Permanent Waiver Request I must attach a completed and signed Physician Affidavit of Permanent Physical or Mental Impairment to this form. If I file jointly I understand that my spouse/RDP must also complete their own FTB 4107 PC and attach their own Physician Affidavit of Physical or Mental Impairment is incomplete or not attached to FTB 4107 PC Mandatory e-Pay Requirement Waiver Request I understand FTB will not approve the request. FTB 4107 PC REV...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign franchise tax board form 4107

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your franchise tax board mandatory e pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb waiver online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ca ftb 4107 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 4107 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ca ftb form 4107

How to fill out CA FTB 4107

01

Download the CA FTB 4107 form from the California Franchise Tax Board website.

02

Review the instructions on the form carefully.

03

Enter your personal information in the designated fields, including your name, address, and Social Security number.

04

Provide information regarding your income, expenses, and any relevant tax credits.

05

Double-check all entries for accuracy.

06

Sign and date the form to certify the information is correct.

07

Submit the completed form according to the instructions provided, either by mail or electronically.

Who needs CA FTB 4107?

01

Individuals who receive California income tax refunds or have overpaid taxes may need to fill out the CA FTB 4107 form.

02

Taxpayers who are claiming a tax credit or refund for the first time.

03

Residents of California who are involved in tax situations requiring the form.

Fill

ca 4107

: Try Risk Free

People Also Ask about pay waiver

What is Form 4107?

This form is used to request a waiver of the mandatory e-pay requirement.

What is the penalty for not paying electronically in California?

The penalty will be equal to 1% of the amount paid unless there was reasonable cause not to pay electronically. A taxpayer is required to make payments electronically when either: An estimated payment or an extension payment is made for over $20,000. A tax return is filed with a tax liability of over $80,000.

What is the FTB penalty for not paying electronically?

Once taxpayers meet the mandatory e-Pay requirement, they must make all payments electronically or they will be assessed a penalty of 1% of the amount paid. There is a reasonable cause exception to the penalty and under certain circumstances, a taxpayer may be granted a waiver of the mandatory e-Pay requirement.

What is mandatory electronic payment notice?

The California e-pay mandate requires taxpayers to submit all future payments to the California Franchise Tax Board via electronic means if the tax liability on the return exceeds $80,000 or if any payment submitted (via any means) exceeds $20,000.

What is the penalty for not paying FTB taxes electronically?

10% of the amount paid by non-EFT. Reasonable cause and not willful neglect. Failure by individuals, whose tax liability is greater than $80,000 or who make an estimated tax or extension payment that exceeds $20,000, to remit their tax payments electronically. 1% of the amount paid.

Is it a requirement to pay taxes electronically in California?

Mandatory e-Pay for individualsWhen electronic payments are required. Electronic payments are required if you either: Make an estimated tax or extension payment over $20,000. File an original return with a tax liability over $80,000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 2917 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form 4107 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get ftb ca gov pay?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the ftb 2917. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out ca franchise tax board payment on an Android device?

Complete your ca efile waiver and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CA FTB 4107?

CA FTB 4107 is a form used by the California Franchise Tax Board for reporting information related to the application for the California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit (YCTC).

Who is required to file CA FTB 4107?

Individuals who qualify for the California Earned Income Tax Credit or the Young Child Tax Credit must file CA FTB 4107 to report their eligibility and claim these credits on their state tax return.

How to fill out CA FTB 4107?

To fill out CA FTB 4107, taxpayers need to provide personal information, including their name, address, and Social Security number. They must also provide details on their income, the number of qualifying children, and other information relevant to the credits being claimed.

What is the purpose of CA FTB 4107?

The purpose of CA FTB 4107 is to assist taxpayers in claiming the California Earned Income Tax Credit and the Young Child Tax Credit, ensuring they accurately report their eligibility and the required information.

What information must be reported on CA FTB 4107?

Information that must be reported on CA FTB 4107 includes taxpayer identification details, income amounts, the number of qualifying children, and any other pertinent information that supports the eligibility for the CalEITC and YCTC.

Fill out your CA FTB 4107 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individuals Whose Tax Liability Is Greater Than 80 000 Or Who Make An Estimated Tax Or Extension Payment That Exceeds 20 000 Must A Request An Installment Agreement B File An Enforced Collection Action C Make A Payment With Check Money Order Or Cas is not the form you're looking for?Search for another form here.

Keywords relevant to franchise tax board forms

Related to california ftb estimated tax payments

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.