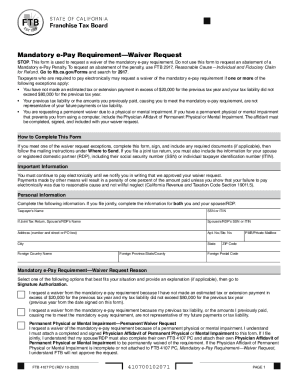

CA FTB 4107 2022-2026 free printable template

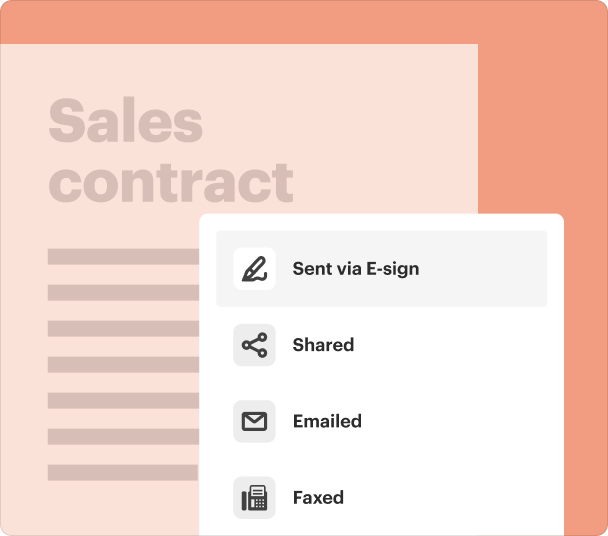

Fill out, sign, and share forms from a single PDF platform

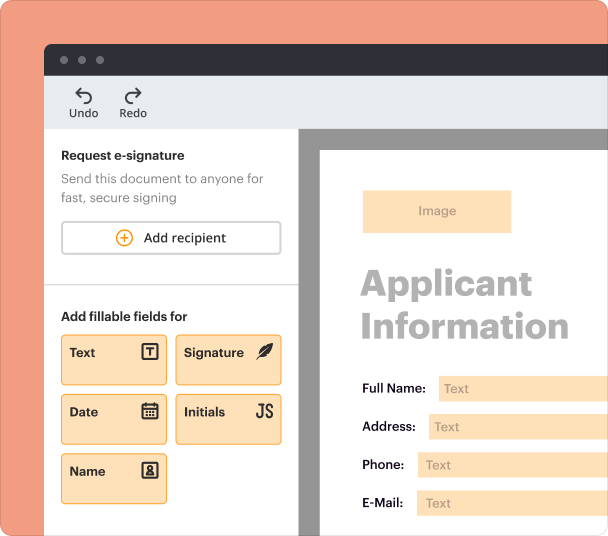

Edit and sign in one place

Create professional forms

Simplify data collection

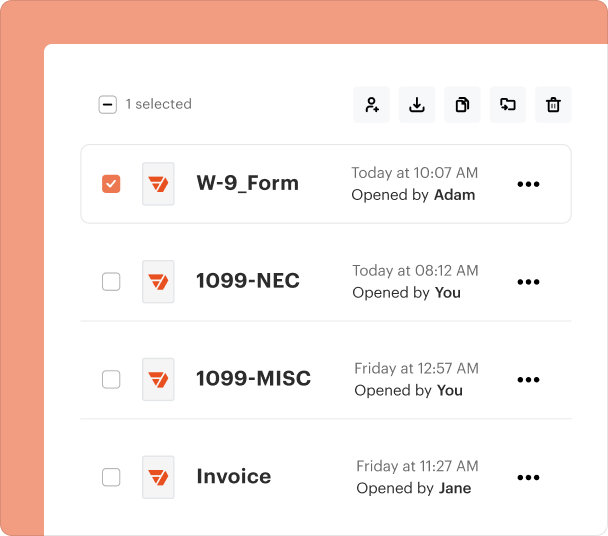

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out the CA FTB 4107 form for 2

Understanding the mandatory e-pay requirement

The mandatory e-pay requirement is essential for certain California taxpayers who must pay their taxes electronically rather than through traditional methods. This policy aims to streamline the payment process and make it more efficient. Notably, businesses with a tax liability of $20,000 or more in the previous taxable year are generally subject to this requirement.

-

Definition and purpose of the mandatory e-pay requirement: It is required to improve the efficiency of tax collection.

-

Who is subject to it?: Generally, businesses that owed $20,000 in the previous year are required to comply.

-

Consequences of non-compliance: Failing to comply can lead to penalties and complications in tax processing.

Eligibility for waiver of the mandatory e-pay requirement

Certain taxpayers can apply for a waiver of the mandatory e-pay requirement under specific conditions. Understanding these eligibility criteria is vital for those who may have difficulty complying due to unforeseen circumstances such as health issues or past tax payment statuses.

-

Criteria for exemption: Taxpayers with previous tax liabilities or payments evidenced by records may qualify.

-

Physical or mental impairments: Taxpayers facing genuine health challenges may also qualify for a waiver.

-

Step-by-step identification of eligibility: Taxpayers should assess their circumstances using a detailed checklist before applying.

Detailed steps to complete the waiver request form

Completing the waiver request form accurately is crucial for success. This process involves collecting necessary documents and filling out personal information correctly, including details about your spouse or Registered Domestic Partner (RDP).

-

Collect necessary documentation: Ensure you have all supporting documents, including a Physician Affidavit if applicable.

-

Completing personal information: Fill in the required personal details, ensuring accuracy to avoid delays.

-

Required signatures: Ensure all necessary parties have signed the document before submission.

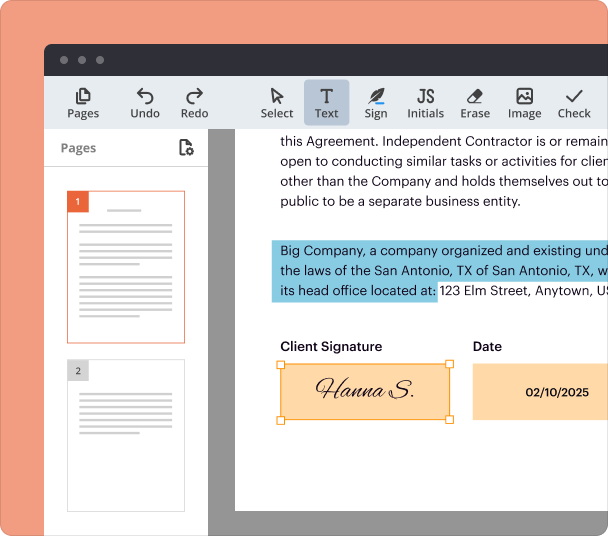

Interactive tools for efficient form management

With PDF filler, users can utilize various interactive tools to manage their forms effectively. These features simplify the process of completing, signing, and storing documents in a hassle-free manner.

-

Utilizing pdfFiller’s editing tools: These tools help you customize your waiver request promptly.

-

Features for eSigning: The platform allows for easy eSigning, making the submission process smoother.

-

Cloud-based storage: Easily access, manage, and share your forms from any location.

Understanding the approval process for waiver requests

After submitting your waiver request, it's crucial to understand what comes next. There are expected timelines and conditions you may encounter during the approval process.

-

What to expect after submission: You will receive confirmation of your request, which could take several weeks to process.

-

Timeline for response: Generally, you can expect a decision within 30–90 days.

-

Potential penalties: Be aware that non-compliance with e-pay rules during the waiting period may incur penalties.

Consequences of non-compliance with waiver requirements

Failing to comply with the waiver requirements can result in several penalties. Understanding these consequences will help taxpayers navigate their obligations effectively.

-

Overview of penalties: Non-compliance can lead to financial penalties and possibly accrue interest on overdue amounts.

-

Importance of communication: Regular communication with the tax authorities can mitigate potential issues arising from non-compliance.

-

Resources for challenges: Taxpayers should use available resources to contest penalties where appropriate.

Frequently Asked Questions about ftb 4107 form

What is the CA FTB 4107 form?

The CA FTB 4107 form is used by taxpayers in California to request a waiver from the mandatory electronic payment requirement. It allows eligible individuals to apply for exemptions based on specific criteria.

Who qualifies for a waiver of the mandatory e-pay requirement?

Taxpayers may qualify for a waiver if they meet specific criteria, such as showing past tax liabilities or facing physical or mental impairments. An assessment of your current financial and health situation is necessary to determine eligibility.

How long does it take to approve the waiver request?

After submitting a waiver request, it generally takes between 30 to 90 days for the tax authorities to respond. During this time, maintaining communication is critical to address any issues.

What penalties may arise from non-compliance?

Non-compliance with the mandatory e-pay requirement can lead to financial penalties, including fines and accruing interest on unpaid amounts. It's crucial to understand these implications when submitting your waiver request.

How can pdfFiller assist in filling out the waiver form?

pdfFiller offers a range of tools that simplify the process of filling out the CA FTB 4107 form, including editing features, electronic signing, and cloud storage solutions. These functionalities enhance the efficiency and ease of managing your documents.

pdfFiller scores top ratings on review platforms